Training

Documentation and videos on Journal Entries and Budget Transfers can be found on SharePoint (log in required).

Documentation and videos on Journal Entries and Budget Transfers can be found on SharePoint (log in required).

If a termination is required, contact the Systems Administrator (financial-systems@strath.ac.uk). Include 'Delete Journal' and the Trans No in the e-mail header.

Once a journal has been posted, it's not possible to change it. If the journal is not correct, a correcting journal should be raised. For example, to reverse the journal posted in error.

See the Journals and Budget Transfers guidance (pdf) (page 21) (login required) for how to attach and view a document.

The approver must reject the virement (follow steps in the Journals and Approval guidance (pdf) (login required) on page 9)

This will send a task to the Systems Administrator who will then complete the rejection/deletion.

Once a virement has been posted it is not possible to change it. Instead if the virement is not correct a correcting virement should be raised (e.g. to reverse the virement posted in error). Please note you must also e-mail the Originator to advise them of the reason for the rejection.

Same as guidance for journals - note Document Type will default as Virements Backup.

A journal should be prepared when transferring Income or Expenditure transactions which have already been recorded on FMS. These can be seen in the Income or Expenditure columns on the Budget Statement.

A virement should be used when transferring funds which have already been recorded on FMS. These can be seen in the Budget or Budget Transfer columns on the Budget Statement).

You would normally use the same account code for the Dr and the Cr side of the journal and the account code should be the same as per the original transaction which you are transferring (unless the original account code was incorrect).

B account codes should not be used for journals these are for budget transfers/virements only.

If you are preparing journals relating to salary costs, you should ensure that you use the relevant X5001 or X5005 code, in order to preserve the detailed level information within the correct accounts. Any entries to X5001 or X5005 will automatically generate entries to 5100.

Only nominated staff should have access to the detailed salary costs and only those staff should prepare the journals for such costs. See Salary Cost Reporting on FMS (pdf) (log in required).

You would normally use the same account code which had been used for the initial budget allocation or virement. This would normally be a B account code (which is generally a more summarised code).

For journals a debit entry represents an increase in expenditure or decrease in income and is shown as +ve when entering the journal, a credit entry represents an increase in income or a decrease in expenditure and is shown as –ve when entering the journal.

|

Purpose of Journal |

Debit or Credit in FMS Journal Entry Screen |

|---|---|

| Increased Expenditure | Debit (+) |

| Decrease Income | Debit (+) |

| Decrease Expenditure | Credit (-) |

| Increase Income | Credit (-) |

Virements are the opposite (as they relate to allocated funds).

For virements a debit entry represents an increase in funds and is shown as +ve, a credit entry represents a decrease in funds and is shown as –ve.

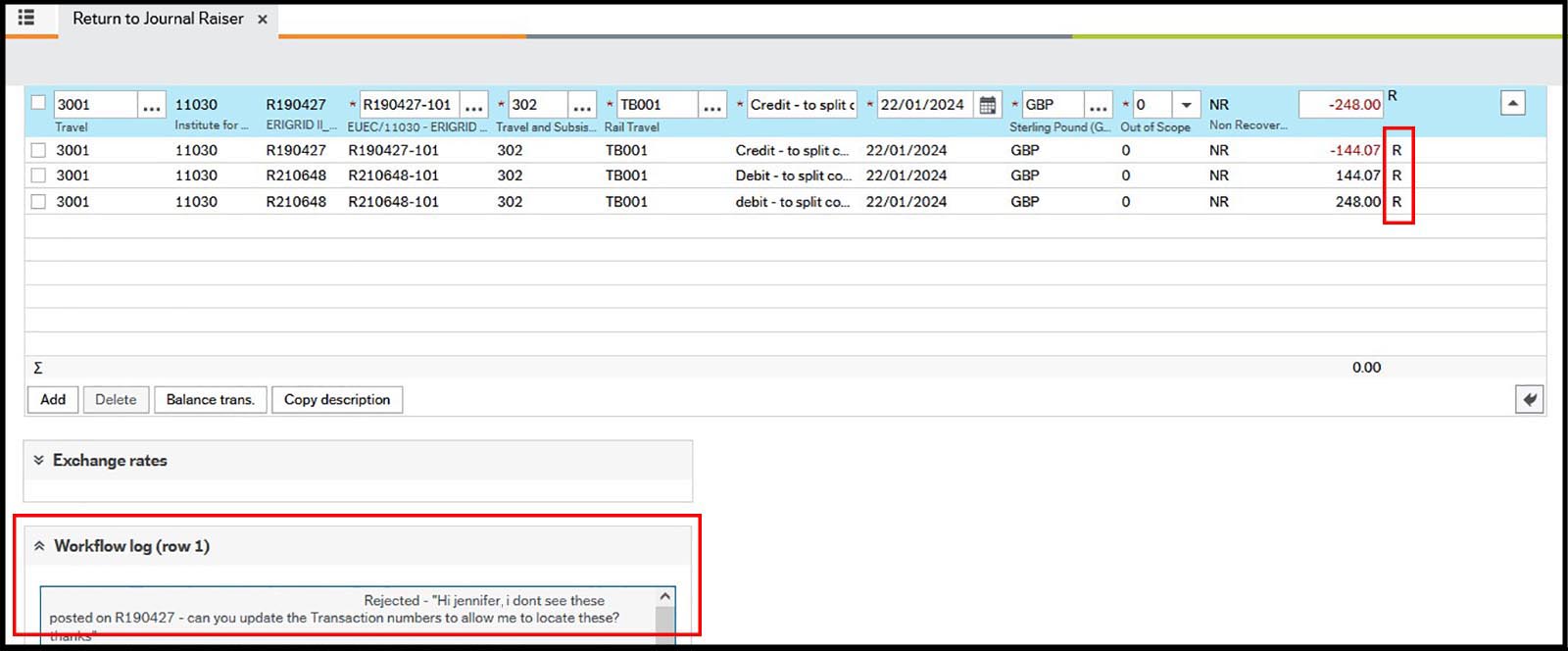

The user must ensure they are sitting in the row which has been rejected (where Workflow status = R). The Workflow log will then display the relevant comments.

For certain student related costs (fees, fees waivers, stipends – see full list here) the student ID must be included. This can only be achieved through the use of an upload template. See Journals relating to Student Costs to find out more.

It is only ever possible to transfer expenditure into a research project, you can never transfer income out.

Please remember to ensure that your expenditure journals have: